Securities and Exchange Board of India (hereinafter referred to as “SEBI”) vide its circular CIR/IMD/DF/51/2017 dated May 30, 2017 released the Disclosure Requirements for Issuance and Listing of Green Debt Securities, in exercise of powers conferred under Section 11(1) of Securities and Exchange Board of India Act, 1992 read with Regulation 31(1) of SEBI ILDS Regulations.

Meaning

Green Debt Securities, also known as Green bonds are debt instruments used to finance green projects that deliver environmental benefits. A green bond is differentiated from a regular bond on the basis of its purpose. The purpose of green bond is to finance or re-finance “green” projects, assets or business activities. Green bonds can be issued either by public or by private actors up front to raise capital for projects or for re-financing purposes, freeing up capital and leading to increased lending.

According to the Circular, a Debt Security shall be considered as “Green” or “Green Debt Securities”, if the funds raised through issuance of the debt securities are to be utilised for project(s) and/or asset(s) falling under any of the following broad categories:

- Renewable and sustainable energy including wind, solar, bioenergy, other sources of energy which use clean technology etc.

- Clean transportation including mass/public transportation etc.

- Sustainable water management including clean and/or drinking water, water recycling etc

- Climate change adaptation

- Energy efficiency including efficient and green buildings etc.

- Sustainable waste management including recycling, waste to energy, efficient disposal of wastage etc.

- Sustainable land use including sustainable forestry and agriculture, afforestation etc.

- Biodiversity conservation

- Any other category as may be specified by Board, from time to time.

Benefits of issuing Green Bonds

A Concept Paper for Issuance of Green Bonds was issued by SEBI[1] on December 03, 2015 which lays down the following key benefits of issuing green bonds:

- Positive public Relations – Green bonds can help in enhancing an issuer’s reputation, as this is an effective way for an issuer to demonstrate its green credentials. It displays the issuers commitment towards the development and sustainability of the environment. Further, this may also generate some positive publicity for the issuer.

- Investor Diversification – There are specific global pool of capital, which are earmarked towards investment in Green Ventures. This source of capital focuses primarily on environmental, social and governance (ESG) related aspects of the projects in which they intend to invest. Thus, green bonds provide an issuer the access to such investors which they otherwise may not be able to tap with a regular bond.

- Potential for pricing advantage – The green bond issuance attracts wider investor base and this may in turn benefit the issuers in terms of better pricing of their bonds vis-a-vis a regular bond. Currently there is very limited evidence available in this regard, however as demand of green bonds increases it is likely to drive increasingly favorable terms and a better price for the issuer. Further, with increasing focus of the global investor community towards green investments, it is expected that new set of investors will enter into this space leading to lowering the cost of funding for green projects.

Green Bonds in India

According to an Input Paper prepared by Organisation for Economic Co-operation and Development (OECD)[2] titled Green Bonds: Country Experiences, Barriers and Options, India entered the green bond market in the year 2015, with a total of USD 1.1 billion of green bonds issued from a handful of pioneer issuers. The first green bond issue in India was by Yes Bank Limited in 2015 for INR 1000 crores which was oversubscribed. This was closely followed by the green bond issue by CLP India for INR 600 crores for its wind portfolio, India’s first certified climate bond issue by Hero Future Energies for INR 300 crores and the first internationally certified green bond issue by Axis Bank Limited for raising USD 500 million which was listed on the London Stock Exchange. The Asian Development Bank (ADB) in 2016 has issued green bonds to support climate change mitigation and renewable energy in India. It has already raised three billion Indian Rupees (£35.7m) from issuing the bonds, which will be channeled into the ReNew Clean Energy Project, a wind and solar power project across six Indian states.

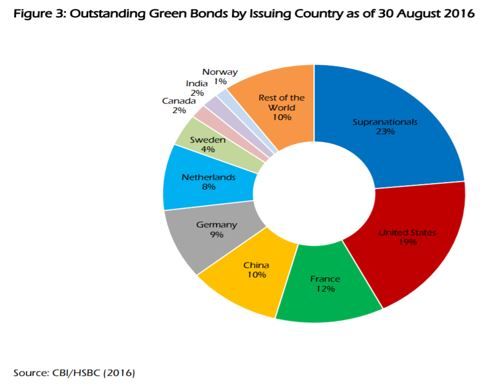

India is one of popular markets when it comes to issuance of Green Bonds. It featured in the 7th position in terms of issuances in 2016 with issuance of USD 2.7 billion, behind United States, France, China, Germany, Netherlands and Sweden.

Disclosure Requirements under the Circular

It is clarified that SEBI (Issue and Listing of Debt Securities) Regulations, 2008 (hereinafter referred to as “SEBI ILDS Regulations”), govern public issue of debt securities and listing of debt securities issued through public issue or on private placement basis, on a recognized stock exchange. Therefore, the requirements placed under the Circular for public issue and listing of Green Debt Securities and listing of privately placed Green Debt Securities are in addition to the requirements as prescribed under SEBI ILDS Regulations.

The additional requirements include disclosures such as – Disclosures in Offer Document/ Disclosure Document and other requirements; Continuous disclosure requirements; Responsibilities of the issuer; and an issuer of Green Debt Securities or any agent appointed by the issuer, if follows any globally accepted standard(s) for the issuance of Green Debt Securities including measurement of the environmental impact, identification of the project(s) and/or asset(s), utilisation of proceeds, etc., shall disclose the same in the offer document/disclosure document and/or in continuous disclosures.

The complete details of the additional requirements are provided under the Circular which may be accessed

here.

Conclusion

India’s green bond market is still small. The Council on Energy, Environment and Water (CEEW) estimates that around USD 1.62 billion of green bonds were issued in India in 2016. Compared to the total issue of USD 81 billion that was issued globally, it’s a very small fraction.

India aims to generate 40% of electricity through renewable energy sources like wind and solar by the year 2030, which would require substantial investment. Green bonds could support deployment of renewable energy projects by providing broader access to domestic and foreign capital as well as better financing terms, including lower interest rates with longer lending terms. SEBI’s statement in the Concept Paper included an explicit mention that SEBI sees the green bond market as a key tool to help raise the finance needed to meet the ambitious targets of India’s Intended Nationally Determined Contribution (INDC) as established for COP21 – essentially India’s climate change action plan. Such a viewpoint from SEBI demonstrates the potential for other countries to utilize the green bond market in order to meet INDCs.

[1]http://www.sebi.gov.in/sebi_data/attachdocs/1449143298693.pdf

Experiences_Barriers_and_Options.pdf